1. How much time do you currently spend on your business?

2. So far I have...

3. I need help with the following...

So far I have...(Select ALL that apply)

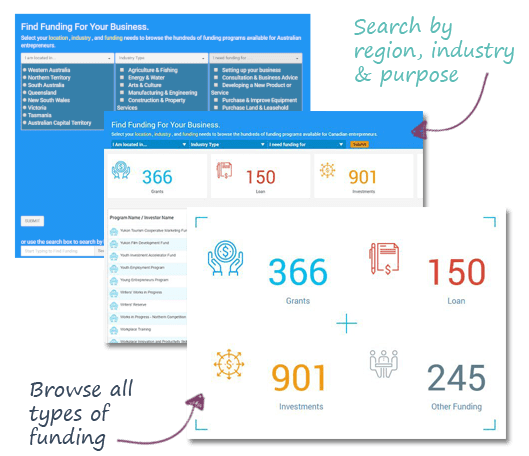

I am located in...

I need funds for...(Select ALL that apply)

At the end of the day, you just need help!

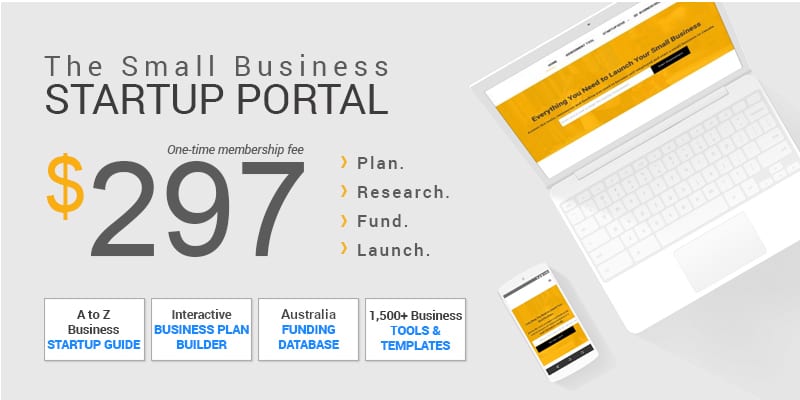

australiaStartups gives you exactly that with a detailed report on what you need to get your small business startup to the next level. A very critical step if you plan on succeeding with your small business.

Access the Complete Startup Edge Right Now!

Scroll down to view your personal Startup Assessment Report and find out what you need to launch in 30 days.

Click Here to Get Access